Builder’s Risk vs General Liability: 7 Critical Differences Every Contractor Must Know

Builder’s Risk vs General Liability—explore the key differences, why both matter for your construction project, and how to avoid costly coverage gaps.

BUILDER'S RISK SERVICES

Ryan Jones

5/27/20254 min read

Introduction to Construction Insurance

Insurance plays a crucial role in any construction project. With so many variables, risks, and potential for property damage or injury, having the right insurance ensures you're not left footing a massive bill. Whether you're a homeowner building a dream house, a contractor managing multiple projects, or a developer handling complex builds, understanding your insurance options is key.

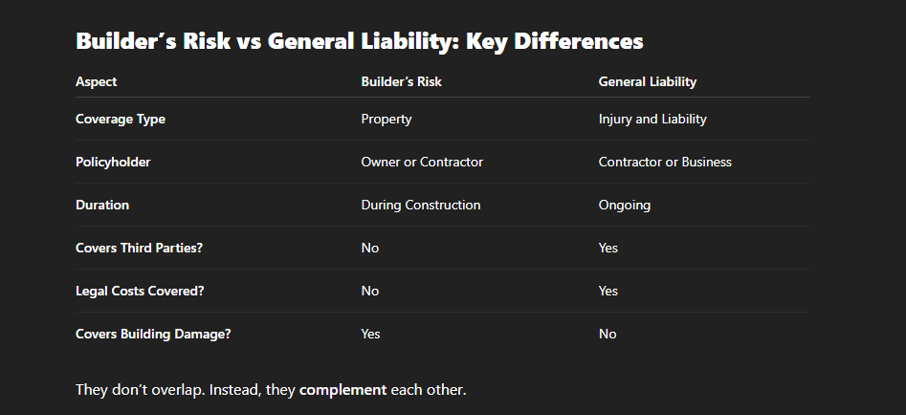

There are two main types of insurance that are often discussed in construction: Builder’s Risk Insurance and General Liability Insurance. Though they sound similar, they serve very different purposes. Understanding the distinction—and why you may need both—is essential for protecting your investments, assets, and legal liability.

What is Builder’s Risk Insurance?

Builder’s Risk Insurance is also known as course of construction insurance. It’s designed to cover buildings and structures while they’re under construction. If a fire breaks out, a storm damages the site, or materials are stolen, builder’s risk insurance helps recover those losses.

Who Needs It?

Property owners

General contractors

Developers

House flippers

Custom home builders

Key Features:

Temporary coverage (only during construction)

Can be purchased by owner or contractor

Usually required by lenders for new builds

Coverage Provided by Builder’s Risk

Builder’s Risk Insurance typically covers:

Property Damage: Damage to the building, on-site materials, or temporary structures.

Theft & Vandalism: If construction materials are stolen or the site is vandalized.

Weather Events: Fire, lightning, hail, and certain types of storm damage.

Equipment Loss: Sometimes covers tools or equipment if explicitly listed.

This policy ensures that the project doesn't halt or lose funding due to unexpected disasters.

Limitations of Builder’s Risk Insurance

Despite its broad coverage, builder’s risk insurance has important exclusions:

No Coverage for Injuries: If someone gets hurt on-site, this policy doesn’t help.

Faulty Workmanship Excluded: It won’t pay for poor construction practices or errors.

Operational Buildings Not Covered: Coverage ends once the project is completed and operational.

Tools and Machinery: Often excluded unless specifically endorsed.

What is General Liability Insurance?

General Liability Insurance is a more standard form of business insurance that protects against third-party claims of bodily injury or property damage. It doesn’t focus on the building itself, but rather the actions or negligence of the contractor or business.

Who is Covered?

Contractors

Subcontractors

Construction businesses

Site managers

Coverage Provided by General Liability Insurance

General liability insurance covers:

Injury to Third Parties: For example, if a passerby trips on a wire and sues.

Damage to Other People’s Property: Say you accidentally damage a neighbor’s fence during excavation.

Legal Costs: Lawyer fees, court costs, and settlement payouts related to covered claims.

Advertising Injury: In some cases, false advertising or slander lawsuits are included.

Why You May Need Both Insurance Types

Using only one of these policies creates dangerous coverage gaps. Imagine this:

A fire destroys your nearly completed home—builder’s risk covers it.

A delivery person trips and sues—only general liability can help.

Having both insurances ensures you're protected from property damage and legal claims, both of which are likely on any active site.

Case Studies: Real-Life Claims Examples

Let’s break down two real-world scenarios to see how each insurance policy functions in practice:

Builder’s Risk Claim Scenario

A residential developer begins construction on a luxury home. Midway through the build, a severe windstorm hits the area, tearing off roofing materials and causing extensive water damage. Since the building was not yet complete, the developer files a claim under the builder’s risk policy, which covers the repairs and the cost of replacing damaged materials.

General Liability Claim Scenario

On a commercial construction site, a subcontractor accidentally leaves tools strewn across a walkway. A delivery driver trips over them and suffers a serious injury. The injured party sues for medical expenses and lost wages. The general contractor’s general liability insurance covers the claim, including legal fees and the settlement amount.

These examples highlight how each policy handles completely different kinds of incidents, reinforcing the importance of carrying both.

Legal and Regulatory Considerations

Each state and municipality may have unique insurance requirements for construction projects. Additionally:

Lenders typically require builder’s risk as part of the financing agreement.

General contractors often must show proof of general liability before pulling permits or signing subcontractors.

Contracts between owners and contractors often specify minimum insurance requirements.

How to File Claims with Both Insurances

When an incident occurs:

Document Everything: Photos, videos, witness statements

Notify Insurer Promptly: Time limits apply

Submit All Required Documentation: Police reports, receipts, invoices

Work with Adjusters: Be transparent and cooperative

Track Repairs or Legal Proceedings: Maintain records for reimbursement

Filing properly can speed up claim processing and reduce stress during an already difficult situation.

Common Myths About Construction Insurance

Let’s bust some common myths:

“Builder’s Risk Covers All Damages” – It doesn’t cover liability or personal injuries.

“General Liability Covers Property Damage to My Site” – It only covers damage to others’ property.

“Homeowner’s Insurance is Enough” – It often excludes construction activities.

“It’s Too Expensive” – Not having coverage can be far costlier.

Understanding these misconceptions can help you make better insurance decisions.

FAQs

1. What’s the main difference between builder’s risk and general liability?

Builder’s risk covers property and materials during construction. General liability covers third-party injuries and property damage caused by your work.

2. Do I need both types for a small renovation project?

Yes—especially if the renovation is significant or involves subcontractors. Builder’s risk can cover your investment, while general liability protects against accidents and lawsuits.

3. Can subcontractors be covered?

Subcontractors often need their own general liability insurance. Builder’s risk policies may include them if listed explicitly.

4. What if I already have homeowner’s insurance?

Homeowner’s insurance often excludes construction-related claims. Builder’s risk is designed specifically for this purpose.

5. Are tools and equipment covered under either policy?

Not always. Builder’s risk may cover them if endorsed, but often you’ll need equipment floater insurance.

6. How can I find the best rates?

Work with an independent broker who specializes in construction insurance and can compare multiple providers.

Conclusion: Protecting Your Construction Investment

Choosing between builder’s risk vs general liability insurance isn't really a choice at all—you likely need both. Builder’s risk ensures your property and materials are safe from natural disasters, theft, and damage, while general liability shields you from lawsuits and third-party injuries.

Together, these policies offer a comprehensive safety net for construction professionals and property owners alike. Don’t wait until it’s too late—protect your project and your finances by securing both types of coverage today.

By Rye and Friends

Your trusted partner for business insurance solutions.

contact

request A quote

© 2025. All rights reserved.

SERVICES

Builders Risk / Course of Construction